Roll-Royce Holdings has reported revenue of £16.307bn for the full year 2017, which is an increase of 6% on underlying basis, with civil aerospace service revenues up 12%. Underlying profit before tax up 25% to £1.071bn, with reported profit before tax of £4.897bn – that figure includes a £2.6bn non-cash profit (2016: £4.4bn loss) from the revaluation of its $38.5bn hedge book as sterling strengthened. The company stated that its free cash flow improvement was driven by improved profits and good working capital management, and that its 2016-17 transformation programme achieved £200m run-rate savings.

Civil Aerospace widebody invoiced flying hours up 12%; significant in-service engine issues: in-year £170m cash cost (2016: £90m) and £227m charge to profit (2016: £98m)

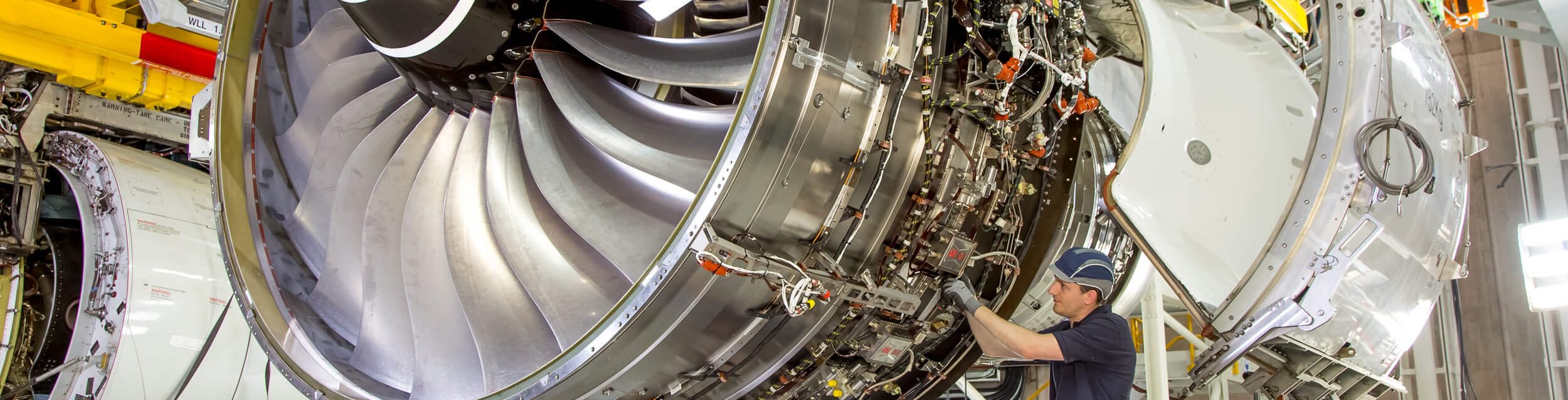

Large engine deliveries up by 35% to a record 483 (2016: 357 engines).

Rolls-Royce reported good further progress with Trent XWB-84 OE economics (cash deficit down 37%) and highlighted the successful UltraFan Power Gearbox testing and Advance3 engine first run completed.

Commenting on the results, Warren East, Chief Executive, said: “Rolls-Royce made good progress in 2017. Financial results were ahead of our expectations and we achieved a number of important operational and technological milestones, but were impacted by the increasing cost and challenge of managing significant in-service engine issues. The business unit simplification and restructuring programme that we announced this January will drive further rationalisation and is a fundamental step in the journey started two years ago to bring Rolls-Royce closer to its full potential both operationally and financially.

We are encouraged by the improving financial performance in 2017 with growing revenues contributing to improved profitability and cash generation. Looking forward, sustaining this improvement and delivering increasing cash flow generation will strengthen our position as one of the world’s leading industrial technology companies.”

Commenting on the Group’s outlook, Warren East added: “As I look to the year ahead, we are embarking on a more fundamental restructuring programme with a refreshed leadership team and an improved market environment. The new business structure provides us with a clearer focus on our customers and markets and, combined with our growing installed base, particularly of widebody engines, delivers the potential to drive sustainable long term free cash flow towards our mid-term ambition of around £1bn by around 2020 with further growth over the subsequent years.

“2018 will be one of significant operational progress. In Civil Aerospace we will continue to grow our installed widebody fleet and further reduce cash deficits on engine sales. At the same time over the next few years we will be continuing to implement solutions for our airline customers to address the in-service engine issues we are currently experiencing, the estimated costs of which are significant but are included in our cash flow, revenue and earnings guidance for 2018 and beyond,” he added.

Rolls-Royce states that its large engine fleet has continued to grow, with over 4,400 engines in active service at the end of 2017, up 7%, on 2016. Invoiced flying hours increased by 12% compared with growth of 4% in 2016. The Trent XWB-84 was called out as a strong contributor to this growth. This engine now represents 6% of the company’s in-service widebody fleet and has achieved over 1.2 million flying hours with unparalleled levels of reliability. It is expected that the Trent XWB-84 fleet will grow to around 1,000 engines over the next five years. The Trent 700 (36% of its total widebody fleet) continued to perform well in service, and achieved a dispatch reliability of 99.9%, said Rolls-Royce. The RB211, Trent 500 and Trent 800 comprise 39% of the widebody fleet and are also performing well in service.

The engine manufacturer noted that it has experienced an “increased level of activity managing significant in-service engine issues on two engine programmes in 2017. This has principally been due to lower than expected durability of a small number of parts for the Trent 1000 (11% of our total widebody fleet) and the Trent 900 (8% of our total widebody fleet).” Rolls-Royce says that these issues have required urgent short-term support including both on-wing and shop visit intervention which “resulted in increased disruption for some of our customers”. It describes the situation as “dynamic” and maintains that its understanding of both the technical and operational issues is improving and that the company is “making solid progress with longer-term solutions, largely through re-designing affected parts.”